Estimated reading time: 6 minutes

Owing to worldwide economic instability and the reality of Covid-19, people’s taste for citrus fruit has increased notably, thanks to the many useful components and exceptional health properties of these fruit. In addition, experts predict that demand for this super fruit will be sustained.

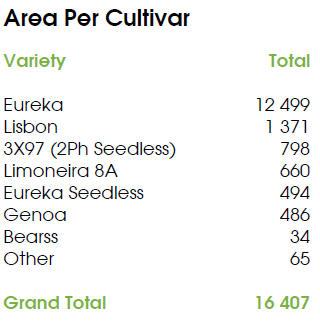

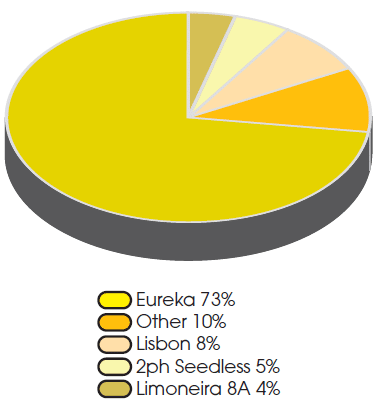

Citrus is currently the highest-value crop produced in the world. In light of this phenomenon, lemon production is now a popular choice in most citrus-producing countries, including South Africa. The lemon is part of the plant family Rutaceae and of all lemon varieties produced in South Africa, Eureka remains the most popular cultivar.

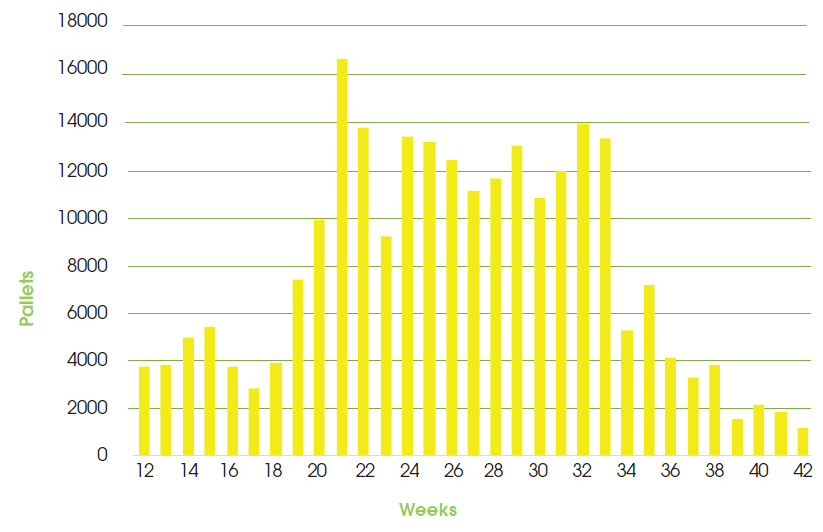

Increased lemon production

South Africa ranks fourth in lemon exports by volume globally, with Turkey currently ranking third. If the current market growth continues, local lemon production will likely exceed that of Turkey next season. On the other hand, South Africa’s realisation of exports is higher per unit than that of Turkey. Thus, South Africa has been overtaking Turkey in value since 2019.

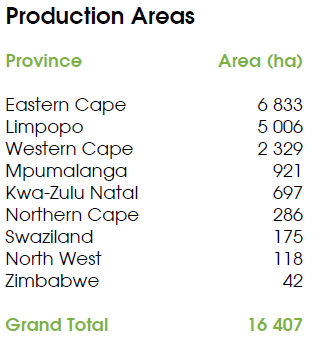

Figure 1: Lemon and lime production areas in South Africa.

South Africa is ranked third in export value and a total of 42% of the country’s lemons went to the European Union (EU) in 2020. Meanwhile, the main importers of locally produced lemons are the Netherlands, United Arab Emirates, the United Kingdom (UK), Russia and Saudi Arabia.

Hannes de Waal, CEO of the Sundays River Citrus Company, acknowledges that global consumption of citrus has skyrocketed. “In most markets, we have seen an increase in demand and apart from expanding markets, we have also seen new markets emerging in South Africa. For example, Iraq is now one of our biggest markets to import local citrus.”

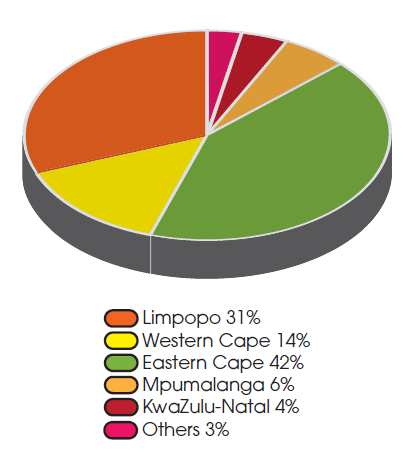

Figure 2: Lemon production area per cultivar.

He continues by referring to the export trade of Spain and Argentina. There, a gap may have been created for South Africa since both countries have been experiencing some quality issues. “South African lemons are up to standard, and we can compete in the most discerning markets,” he says. “The Sundays River Valley may well be the best place in the world to grow lemons, as yield is high and quality is good. I believe the success of the citrus growers over the past decade encouraged other South African growers to follow.”

Nevertheless, Hannes advises growers to be cautious about the following:

- The juice and oil market has been depressed for three years now, and overall global consumption may be stagnant.

- The industry’s growth has been significant and rapid. Export markets need to stretch now and that may not happen quickly enough. South Africa has now exceeded the volume of lemons it exported a decade ago. The country has also exceeded the volume of citrus Argentina exported ten years ago. However, Spain has replanted orchards in the meantime and growers are much more professional than two decades ago. At this stage, a commodity war waged at low prices is not an impossible scenario.

- Severe price competition is evident in many citrus markets and with volumes still expected to increase, returns may become uneconomical. One must always keep in mind that it is a commodity after all. There is no guarantee that markets will continue to consume volumes at prices that cover the cost of production.

Export standards and requirements

According to the Bureau for Food and Agricultural Policy (BFAP), a total of 42% of South Africa’s lemons went to the EU (still including the UK) in 2020.

In terms of fruit quality, export standards and requirements mostly determine whether the fruit qualify for export. The Agricultural Product Standards Act, 1990 (Act 119 of 1990) determines the standards and requirements regarding control of citrus exports.

For processing purposes only, it can be summarised as follows:

- ‘Minor endoxerosis’ means pink to light brown discolouration at the stylar end and core of the fruit together with drying out of the juice vesicles.

- ‘Major endoxerosis’ means the dark brown to black discolouration stage affecting the albedo and core of the lemons with or without tissue collapse and water saturation.

- ‘Lemons’ refer to the fruit grown from cultivars of the species Citrus limon (L.) Burm. f.

In addition, each market has its own requirements in terms of quality, packaging, cooling, shipping, temperatures, etc. These requirements mostly centre on minimum residue levels of pesticides and other contaminants and phytosanitary regulation of fruit flies, citrus black spot (CBS) and false codling moth (FCM). Quality, maturity and size, as well as packaging and labelling are also important aspects to consider.

South African lemon biosecurity and export matters

Although the South African citrus export industry has performed exceptionally well recently, there are still risks such as CBS and invasive pests and diseases with which to contend.

According to Kandas Cloete, a horticultural analyst at BFAP, the organisation conducted a study on the implication at farm and packhouse level regarding the cost incurred to manage CBS for the citrus industry in 2017. “If one were to lose access to markets such as the EU, the direct and opportunity costs would be substantial,” he says. “Consequently, a lot of time, effort and money is going into the prevention and management of pests and diseases throughout the value chain to prevent the spread.” – Carin Venter, AgriOrbit

The official standards and requirements for citrus in general and for lemons specifically.

Export standards and requirements (part 2) for lemons.

A practical explanation of how the standards and requirements are applied.

Official standards and requirements regarding control of lemon export.

Each market has its own requirements in terms of quality, packaging, cooling, shipping, temperatures, etc. For example, here are the standards and requirements to enter the EU.

For more information, contact:

Bureau for Food and Agricultural Policy (BFAP) at Kandas Cloete, Kandas@bfap.co.za.

Citrus Growers Association (CGA) at info@cga.co.za.

Sundays River Citrus Company (SRCC) at srcc@srcc.co.za.