- Traditionally, between 30 and 50% of a grain and oilseed producer’s existing input costs are spent on fertiliser. Fertiliser makes up such a large portion of input costs that any change, especially a price increase, can affect profitability drastically.

- As of 2009, fertiliser imports of monoammonium phosphate (MAP), ammonia, urea and potassium chloride have increased by 103% in total. During 2021, South Africa imported a total of 1 803 348 tons of just these four fertiliser products from various countries.

- Fertilisers, which account for between 30 and 50% of input costs, have become less and less affordable, which means that the producer’s margin for trade has weakened excessively.

- Although fertiliser prices are following a downward trend and, according to the affordability index, are becoming more affordable, inputs for the current season were purchased when prices were higher.

Traditionally, between 30 and 50% of a grain and oilseed producer’s existing input costs are spent on fertiliser. Fertiliser makes up such a large portion of input costs that any change, especially a price increase, can affect profitability drastically.

Because South Africa is a net importer of fertiliser, it further aggravates the situation since all imported fertilisers are not only affected by their actual price but by a whole range of factors such as the exchange rate and transport costs.

Read more about how fertiliser can be used in regenerative agriculture.

Import volume and price changes

Figure 1 illustrates South Africa’s fertiliser imports of monoammonium phosphate (MAP), ammonia, urea and potassium chloride from various countries since 2009. Although not the only fertilisers imported, these are four of the five most important products imported.

As of 2009, fertiliser imports for these four products have increased by 103% in total. During 2021, South Africa imported a total of 1 803 348 tons of just these four fertiliser products from various countries. Besides the increase in import volume, the exchange rate of the Rand to other major currencies also weakened sharply from 2009 onwards, which further intensified the effect of price increases. In 2022, almost 1,6 million tons of these four products had been imported, showing a 12% decrease from 2021.

Table 1 contains the average price changes for nitrogen (N), phosphate (P) and potassium (K) during April last year, compared to April 2023. It is a welcome relief to see a slight decline in prices compared to the previous year.

Looking at the fertiliser requirements of different regions of the country, the western Free State uses and average of 72 units of N, 16 units of P and 14 units of K per hectare; the eastern Free State uses 100 units of N, 19 units of P and 27 units of K per hectare. Irrigated areas use 286 units of N, 52 units of P and 80 units of K per hectare.

Table 2 provides a comparison of the average fertilisation requirements for these three regions for April 2022 and April 2023. On average, the cost of fertiliser declined by 36%.

Read more about optimising fertiliser timing here.

Fertiliser affordability

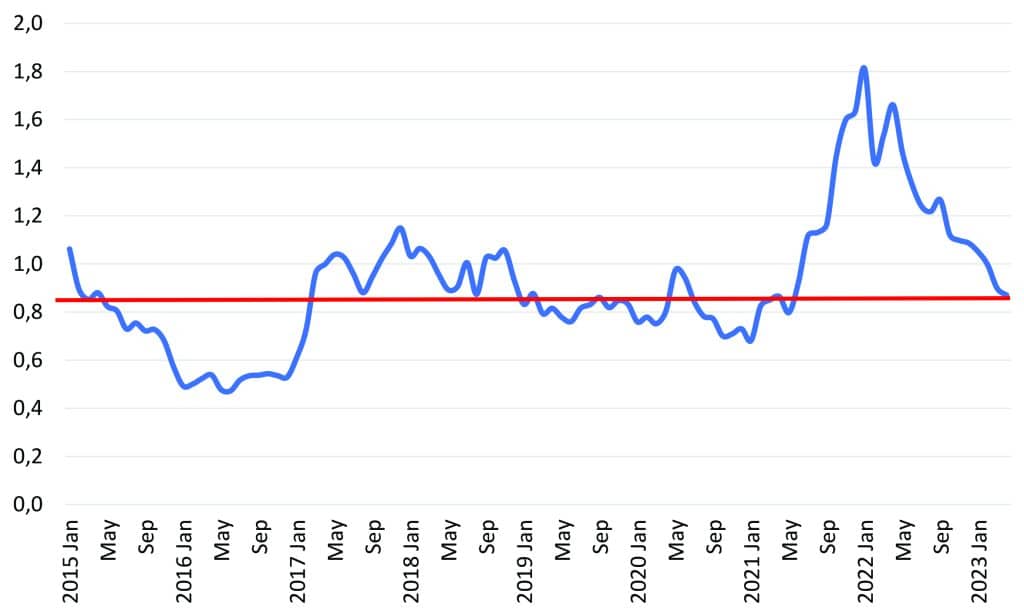

Figure 2 indicates the affordability of fertilisers compared to the Safex price of maize. Fertilisers, which account for between 30 and 50% of input costs, have become less and less affordable, which means that the producer’s margin for trade has weakened excessively. This puts pressure on the producer’s profitability and can result in fewer hectares being planted, especially maize. Recently, fertiliser prices have declined due to the market becoming more accustomed to the Russian-Ukraine war and declining energy prices.

This information paints a clear picture of the extreme challenges that producers face every day while trying to stay afloat. Fertiliser is not the only input cost that has seen sharp price hikes; the cost of energy sources such as fuel and electricity have also risen sharply, as has the price of seed and chemicals. It is becoming progressively more difficult for farming operations to remain profitable and sustainable.

Although fertiliser prices are following a downward trend and, according to the affordability index, are becoming more affordable, inputs for the current season were purchased when prices were higher.

Since there is little room for mistakes, producers must make sure they are not being taken for a ride by fertiliser suppliers. Do the homework, make sure the representative’s prices are market-related, compare offers to find the best price, and select the most suitable offer for your purposes. – Christiaan Vercueil, Grain SA

Figure 1: Four of the five most important fertilisers South Africa imports.

Figure 2: The affordability of fertiliser.

Table 1: Price comparison of nitrogen, phosphate and potassium for April 2022 and April 2023.

| Nitrogen | Phosphate | Potassium | |

| Average price: April 2022 (R/kg) | R47,20 | R95,70 | R47,70 |

| Average price: April 2023 (R/kg) | R28,90 | R68,60 | R28,70 |

| Change (year-on-year) | -39% | -28% | -40% |

Table 2: Change in fertiliser cost per hectare for April 2022 compared to April 2023.

| Nitrogen | Phosphate | Potassium | Price: January 2022 | Price: January 2023 | Change | |

| Eastern Free State: Average units (kg/ha) | 100 | 19 | 27 | R7 826 | R4 968 | -37% |

| Western Free State: Average units (kg/ha) | 72 | 16 | 14 | R5 597 | R3 580 | -36% |

| Irrigation: Average units (kg/ha) | 286 | 52 | 80 | R22 292 | R14 129 | -37% |

For more information, contact Christiaan Vercueil at 086 004 7246 or visit www.grainsa.co.za.