Estimated reading time: 16 minutes

- Severe weather conditions across the globe have impacted potato crops, leading to smaller harvests in the United States (US), Europe and Australia last year. Europe faced drought, while Australia dealt with heavy rainfall.

- Planting conditions in the US and Canada appear favourable, potentially leading to larger potato crops. However, producers in the US face the long-term threat of climate change, with 80% of cropland at risk by 2040.

- Canada is expected to exceed its record potato crop from last year by increasing plantings. North American Potato Market News (NAPMN) anticipates a 2.3% expansion in plantings, totalling 396 000 acres (160 256 ha).

- Despite the recent public holidays, potato prices in Europe have surged to record highs of over €400/ton for processing potatoes. Strong demand and delayed plantings have contributed to the price increase.

- Indian fry exports regained momentum following initial supply problems during the start of the Indian rabi (spring) harvest. This recovery came after a decline in sales in January.

Severe weather conditions across the globe have impacted potato crops, leading to smaller harvests in the United States (US), Europe and Australia last year. Europe faced drought, while Australia dealt with heavy rainfall. This season, Europe is already feeling the effects of extreme weather, with record-high temperatures in Spain and Portugal causing reservoirs in southern Spain to dip below 30% capacity.

In addition, a cold and wet spring in northern Europe has delayed planting and hindered crop growth. As a result, potato prices have soared, with the average Spanish price surpassing €700/ton for the first time. In France, Belgium and Germany, prices of at least €400/ton have become the norm for processing potatoes.

Conversely, planting conditions in the US and Canada appear favourable, potentially leading to larger potato crops. However, producers in the US face the long-term threat of climate change, with 80% of cropland at risk by 2040. The challenges faced by the US and Europe have opened up opportunities for potato-exporting countries elsewhere such as China, India and New Zealand.

Largest crop since 2018 for US

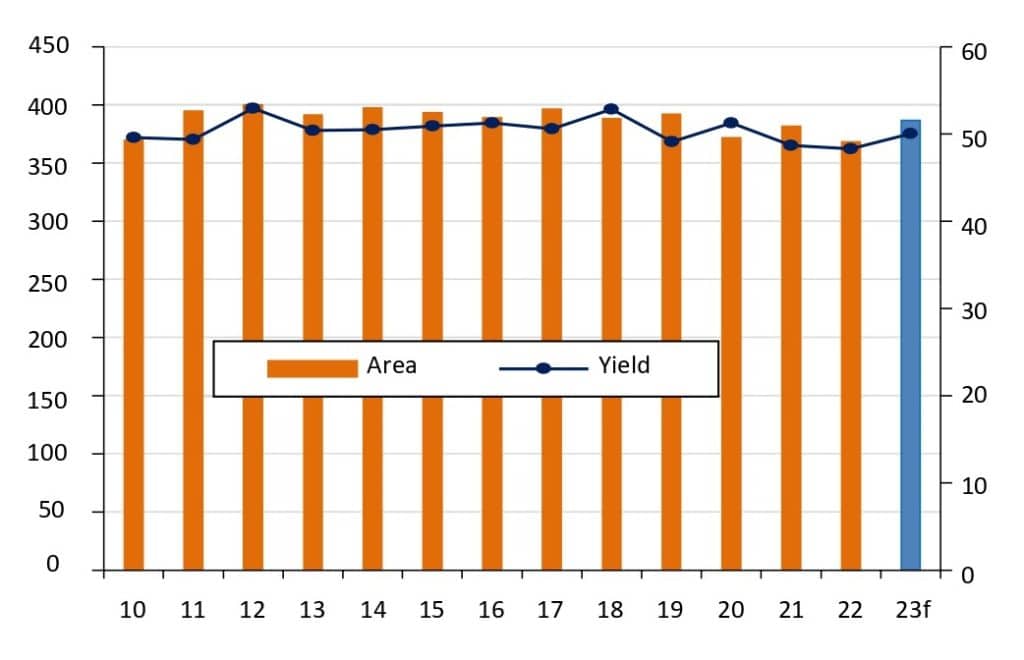

Following a historically small potato harvest in 2022, which resulted in supply shortages and price increases, the upcoming potato crop in the US is expected to be the largest since 2018. Although this projection is based on anecdotal evidence and previous market trends rather than scientific analysis, there is optimism for a 5% increase in the planted potato area reaching 368 678 ha – the highest since 2019. With an estimated yield of 50.1 tons/ha, the national potato crop for 2023 could amount to 19.634 million tons, marking a significant increase.

Figure 1: US potato area and yield.

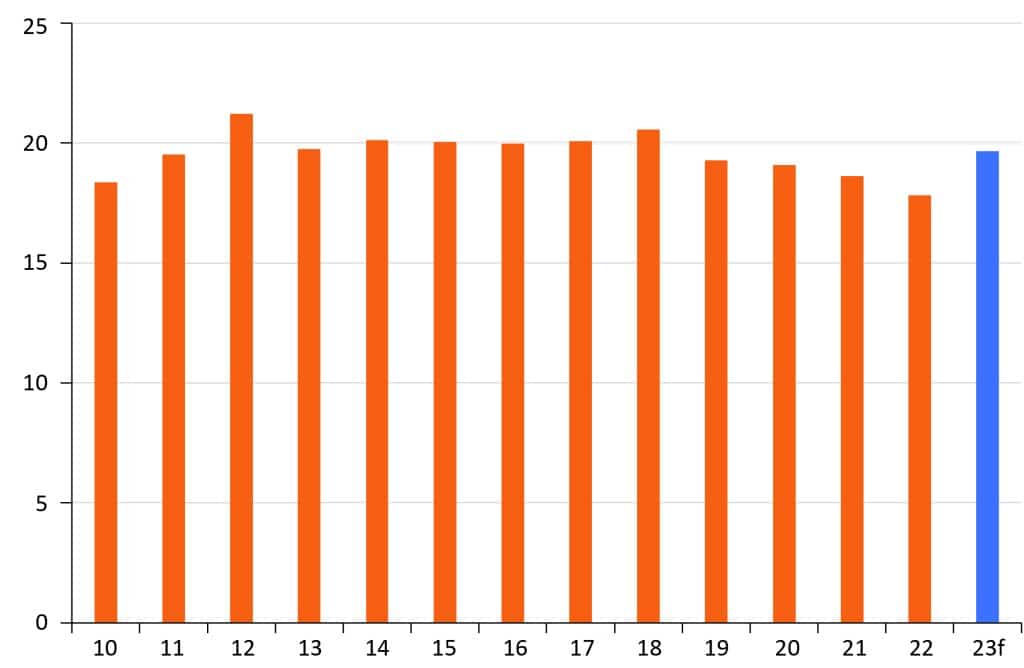

Figure 2: US potato production in million tons. (Source: USDA)

Table 1: US potato production from 2018 to 2023. (Source: USDA & WPM estimates for 2023)

| 2023f | % change | 2022f | % change | 2021 | 2020 | 2019 | 2018 | |

| Planted area in ‘000 ha | 386.678 | +5.0 | 368.265 | -3.5 | 381.619 | 371.704 | 391.858 | 388.418 |

| Yield tons/ha | 50.1 | +3.6 | 48.3 | -0.8 | 48.7 | 51.3 | 49.1 | 52.9 |

| Production in million tons | 19.634 | +10.3 | 17.793 | -4.3 | 18.590 | 19.052 | 19.251 | 20.530 |

Read more about the affect of fertiliser on potato production.

Canada could surpass 2022 record

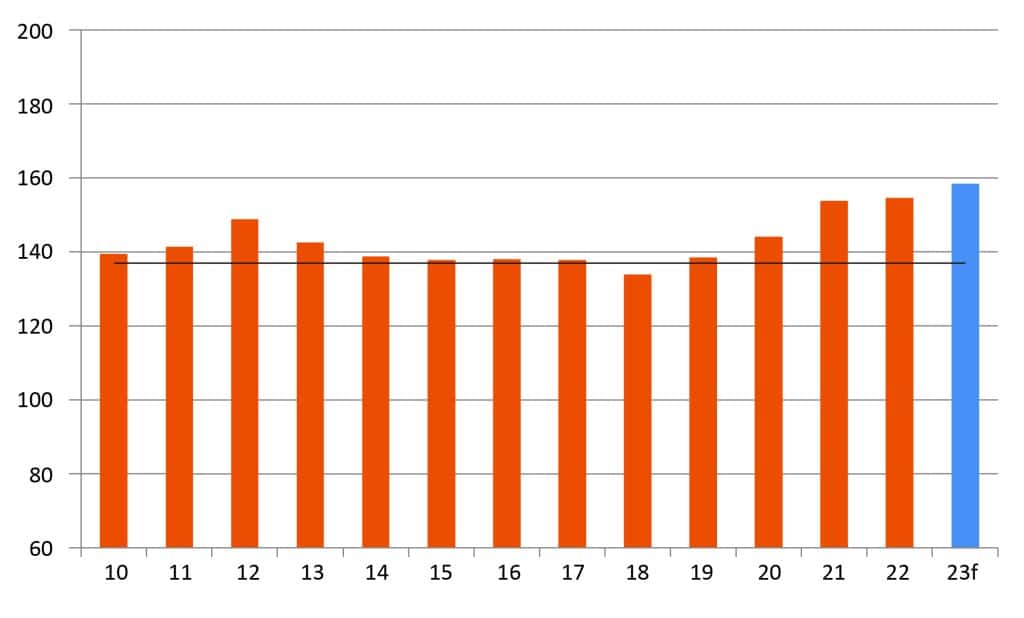

To address supply shortages in North America and beyond, Canada is expected to exceed its record potato crop from last year by increasing plantings. North American Potato Market News (NAPMN) anticipates a 2.3% expansion in plantings, totalling 396 000 acres (160 256 ha). Notably, Prince Edward Island is projected to witness a 2.8% increase, while the total eastern Maritimes area is expected to grow by 1.8%. In the Prairie area, a significant rise of 3.3% is forecast, primarily driven by a 5.4% increase in Alberta and an impressive 12.7% surge in Saskatchewan.

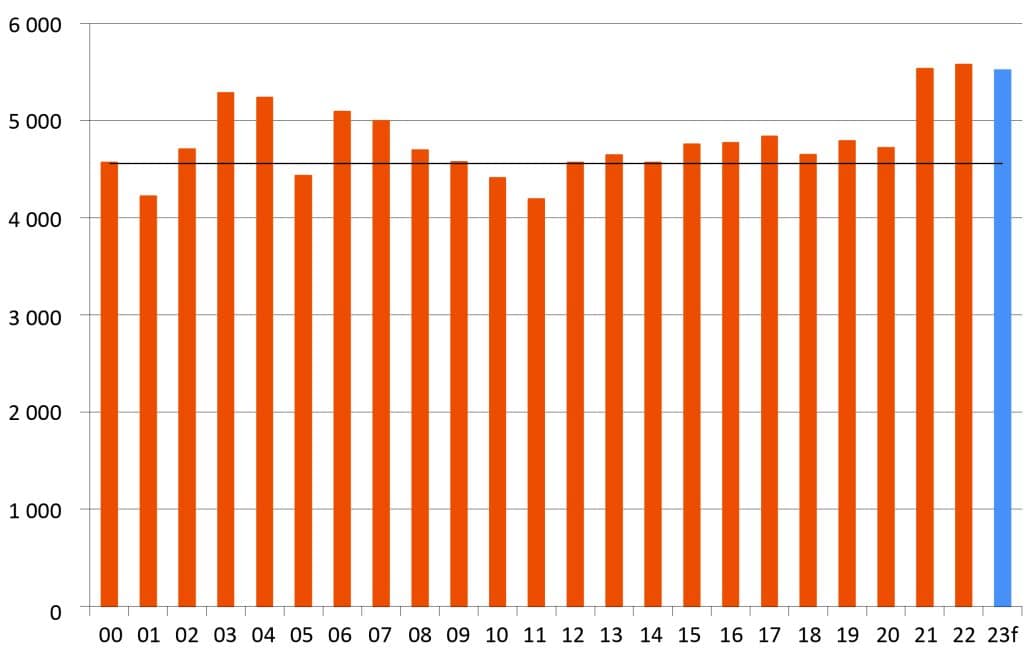

Based on estimates, assuming a 2.5% national increase in the planted area, they anticipate a total of 160 359 ha. If the same harvest loss of 1.3% as last year is experienced, the harvest area would amount to 158 274 ha. Maintaining the five-year average yield of 34.9 tons/ha (2018 to 2022) would result in a crop of 5.519 million tons. However, if last year’s average yield of 36.1 tons/ha is achieved, it could potentially yield a record-breaking harvest exceeding 5.7 million tons.

Both the US and Canada are expected to continue the trend of increasing the production of processed potatoes. In the 2021/22 season, according to the USDA, 64.3% of the US potato crop was utilised for processing purposes.

Figure 3: Planted area of potatoes in Canada (‘000 hectares)

Figure 4: Canadian potato production (‘000 tons)

European prices above €400/ton

Despite the recent public holidays, potato prices in Europe have surged to record highs of over €400/ton for processing potatoes. Strong demand and delayed plantings have contributed to the price increase.

In Belgium, the Belgapom price skyrocketed by €50/ton to reach €400, surpassing the previous mark of €300/ton set in the 2018/19 season. Trade reports indicate that processors are willing to pay prices exceeding €400/ton to secure supply, emphasising the seller’s market.

Prices are on the rise across Europe, with Germany’s Rhineland organisation, REKA, reporting a recent average price of €402.50/ton, ranging from €395 to €410/ton.

Reflecting a relatively more abundant harvest in 2022, the main PotatoNL price in the Netherlands surged by 13% to an average of €392.50/ton, reaching another all-time record.

French processing potato prices also hit €400/ton, marking a €50/ton increase for all types. Current prices are €150/ton higher compared to the beginning of the season and double the prices from a year ago.

Notably, export prices in France have also witnessed an increase, reaching new highs with a €10 to €20/ton surge. The absence of a benchmark Agata bulk price quote suggests that stocks may already be running low. In contrast, table potato prices have experienced minimal movement.

Delayed planting due to wet weather and hindered crop growth caused by cold conditions have impacted potato production in northwest Europe this year. While temperatures are expected to rise above 20°C in parts of northern France and warmer conditions are anticipated elsewhere, the forecast also includes more rain, which may further slow down planting progress. The current wet weather increases the risk of shallow rooting, making the crops more vulnerable to potential hot and dry weather later in the season.

Spring in Spain

Record-breaking spring temperatures in Spain, reaching 38.7°C in Cordoba on 27 April, have had a significant impact on the potato crop. This temperature surpassed the previous April record of 37.4°C set in Murcia 12 years ago. In addition to the extreme heat, the country is also grappling with drought, with 27% of Spanish territory facing water shortages and being on alert or in an emergency.

As of 25 April, the national water reserve was at 50.1% of its capacity. However, public reservoirs in the southern regions of Spain are at alarmingly low levels: 24.8% in Guadalquivir, 27.9% in Guadalete-Barbate, 34.6% in Segura, and 36.2% in Cuenca Mediterránea Andaluza.

In response to the challenging drought conditions, Spanish minister of agriculture, Luis Planas, appealed to the European commissioner for agriculture, Janusz Wojciechowski, during the Agriculture and Fisheries Council (AGRIFISH) meeting held on 25 April. Minister Planas requested support for Spanish producers and cattlemen in this “exceptional” drought situation.

Specifically, he asked for advanced common agricultural policy (CAP) annual payments for this year and early payment of over 50% of the funds owed. He also sought the activation of the CAP crisis reserve and proposed allowing autonomous communities to use unexecuted funds from the LEADER programme (rural development programme) to support affected farms.

Table 2: Spanish potato area, yield, production and ex-farm price. (Data source: Ministerio de Agricultura, Alimentación y Medio Ambiente)

| Area (‘000ha) | 2023 | % change | 2022 | % change | 2021 | 2020 | 2019 | 2018 | 2017 |

| Extra early | 3.227 | 6.3 | 3.037 | -1.6 | 3.087 | 3.440 | 3.597 | 3.647 | 3.917 |

| Early | 12.601 | -6.5 | 13.481 | 1.1 | 13.339 | 13.449 | 13.907 | 14.386 | 14.433 |

| Total early | 15.828 | -4.2 | 16.518 | 0.6 | 16.426 | 16.889 | 17.504 | 18.033 | 18.350 |

| Middle | 28.717 | -3.9 | 29.879 | 3.2 | 28.962 | 30.682 | 30.474 | 29.899 | 31.633 |

| Late | 17.096 | -4.5 | 17.895 | 17.833 | 19.583 | 19.556 | 20.895 | ||

| Total | 63.493 | 0.3 | 63.283 | 65.404 | 67.561 | 67.488 | 70.878 | ||

| Yield (t/ha) | |||||||||

| Extra early | 25.6 | 25.1 | -4.4 | 26.2 | 23.6 | 23.5 | 20.8 | 23.5 | |

| Early | 29.7 | -10.0 | 33.0 | 30.6 | 31.2 | 27.3 | 30.2 | ||

| Total early | 28.9 | -9.1 | 31.8 | 29.1 | 29.6 | 26.0 | 28.7 | ||

| Middle | 27.3 | -5.7 | 28.9 | 28.8 | 29.6 | 27.4 | 29.8 | ||

| Late | 37.6 | -6.8 | 40.4 | 37.8 | 41.7 | 37.0 | 36.8 | ||

| Total | 30.5 | -7.3 | 32.9 | 31.4 | 33.1 | 29.8 | 31.6 | ||

| Production (‘000 t) | |||||||||

| Extra early | 82.618 | 8.5 | 76.126 | -5.9 | 80.901 | 81.156 | 84.367 | 76.034 | 92.094 |

| Early | 400.739 | -9.1 | 440.740 | 410.992 | 434.185 | 392.675 | 435.374 | ||

| Total early | 476.865 | -8.6 | 521.641 | 492.148 | 518.552 | 468.709 | 527.468 | ||

| Middle | 814.4 | -2.7 | 836.738 | 884.716 | 901.471 | 818.353 | 942.171 | ||

| Late | 643.4 | -11.0 | 722.727 | 674.969 | 817.100 | 723.871 | 769.831 | ||

| Total | 1 934.665 | -7.0 | 2 081.106 | 2 051.833 | 2 237.123 | 2 010.933 | 2 239.470 |

The early potato area in Spain has decreased significantly, with a revised figure of 12 601 ha, down 6.5% from last year’s 13 481 ha. Andalucia maintained a similar planting area, while Murcia witnessed a 14.1% decline. The Canary Islands, Galicia and the Baleares Islands also reported reduced areas for early potatoes. However, the Spanish extra-early potato harvest saw an upward revision, with production increasing by 8.5% to 82 618 tons from 3 227 ha. The average yield per hectare slightly exceeded last year’s average. Overall, the total potato area in Spain is expected to decline, including the combined area for extra-early, early and middle-season potatoes.

Spain also experienced a record ex-farm price of €718.6/ton, likely due to factors such as low stocks, delayed harvests and lower yields. Producers in the Valencia region anticipate a yield reduction despite an increase in planted area.

Learn more about Eastern Cape potato producers.

Portugal sees 5% growth

According to the Instituto Nacional de Estatistica, the potato area in Portugal is estimated at 14 600 ha, a 5% increase compared to last year. The irrigated potato area has risen by 600 to 12 600 ha, while the non-irrigated area remains unchanged at 2 000 ha. These estimates align with forecasts from Porbatata, confirming a recovery in the planted area, especially in the central and northern regions, which are traditional market areas.

Portugal has witnessed an 18% increase in imports of seed potatoes, reaching 13 687 tons in January and February, compared to 11 633 tons in the same period last year. This rise in imports could support further expansion of the potato area in Portugal this year.

Showers are forecast for the western, central and northern coastal regions this week, benefitting potato development. Maximum temperatures will range from 24 to 34°C, with the south experiencing showers only on 6 May and temperatures potentially reaching 36°C, requiring irrigation.

In terms of drought, during the first half of April, 78.2% of Portugal was in a meteorological drought, as reported by the country’s meteorological agency, IPMA.

The average ex-farm price of new potatoes increased to €1 030/ton in the week leading up to 23 April, marking a 3% increase compared to the previous week and a significant 98.8% increase compared to the same week last year, according to SIMA-GPP. Market prices in the Algarve ranged from €800/ton to €1 100/ton for white-skinned potatoes, depending on size. In the Entre Douro e Minho market, the average price for white-skinned potatoes stood at €1 000/ton.

Late planting affects UK market

The UK potato market has been impacted by cold and wet weather, similar to mainland Europe, resulting in delayed planting and potentially the smallest area on record.

Growers are encountering issues such as compaction and rooting problems, which will affect crop growth throughout the season. To compensate for the extended maturation period, some growers are prioritising maincrop planting over second earlies. It is anticipated that plantings in Great Britain (England, Scotland and Wales) will not exceed 100 000 ha, with the most significant reductions observed in the fresh table-packing potato sector. Increased demand and higher contracts have led growers to shift towards processing potatoes.

Late planting and diminishing stocks have contributed to higher prices for old crop potatoes. The Potato Call newsletter reports prices of up to £400 for 2022 crop white potatoes. Premium quality bagged chipping potatoes are fetching prices exceeding £500 per ton.

Indian fry exports rebound

Indian fry exports regained momentum following initial supply problems during the start of the Indian rabi (spring) harvest. This recovery came after a decline in sales in January. In February, total exports reached 8 444 tons, showing a 1.3% increase compared to the previous year and marking the end of two months of declining sales. The business performance was further aided by a slight dip in average prices, at the time of this article standing at IR 116 285/ton (US$1 423/t; €1 278/t).

Notably, the average export price for Indian fries rose by 72.3% compared to a year ago. Although sales figures did not show significant change from 2022, export earnings experienced a substantial increase of 74.6%, reaching IR 981.9 million (US$12 million; €10.8 million).

India’s largest customer, the Philippines, significantly increased its purchases of Indian fries, reaching 2 911 tons compared to 348 tons previously. This represents a 76% increase from the previous year, despite the Filipino price of

IR116 863/ton (US$1 430/t; €1 285/t), which is 77% higher than last year. Over the course of 12 months, sales to the Philippines have surged by 63.8% to 35 713 tons, making the country responsible for 40% of India’s total fry exports.

Thailand’s purchases also improved compared to January, reaching 2 821 tons. However, this figure is still 25.9% lower than the previous February. Prices in Thailand have increased by 75.1% since then, reaching IR117 242/ton (US$1 434/t; €1 289/t). Meanwhile, Indonesia witnessed a significant price rise of 94.3% to IR118 903/ton (US$1 455/t; €1 307/t), but managed to purchase 806 tons, marking its highest purchase since last April. Yearly business with Indonesia has increased by 53.4% to 5 979 tons. Vietnam followed closely, with February purchases of 514 tons increasing its annual sales tenfold to 5 214 tons. The price in Vietnam has risen by 61.6% over the past year to IR106 378/ton (US$1 301/t; €1 170/t).

In contrast, sales to Malaysia in February decreased by 38.9% to 476 tons, with a price of IR115 405/ton (US$1 289/t; €1 269/t). South Africa offers a much lower price of IR89 031/ton (US$1 089/t; €979/t), but its sales experienced a significant drop of 63.2% to just 96 tons. Overall, Indian fry sales have grown by 43.2% to 89 963 tons compared to last year, resulting in earnings that are 107.6% higher at IR8.1 billion (US$99 million; €89 million).

China’s fry exports in high demand

China’s fry exports continue to grow, having reached a monthly record of 13 467 tons, which is 73.5% higher than the previous year. Strong demand from Japan and Malaysia helped offset the decline in demand from China’s leading import markets, the Philippines and Thailand.

Sales to Japan increased by 150 tons, reaching 2 268 tons, a 45.1% increase from a year ago. Despite a significant increase in the import price, the Japanese market remains strong. The price was 11.9% higher than a year ago, while the overall export price increased by 42.3%. Annual sales to Japan have grown by an impressive 154.1% this year, totalling 22 996 tons.

Sales to Malaysia tripled compared to February, reaching 1 407 tons, despite a price that was 80.6% higher than last year. Over the course of 12 months, sales to Malaysia have increased by 249.9% to 5 326 tons. In comparison, Indonesia’s price, which rose by 54.0% over the past year, remains lower. Sales to Indonesia decreased to 1 889 tons, but China’s fry business with Indonesia has still grown by 438.1% year-on-year.

The Philippines, China’s biggest export customer, saw a slight decrease in sales to 2 473 tons, a drop of 26.9% compared to last year. The annual sales growth to the Philippines is no longer as impressive, standing at 28.5% over the past 12 months. In contrast, China’s business with the rest of the Southeast Asian market is growing more rapidly. Sales to Thailand also decreased to 2 384 tons, but they are still significantly higher than in March 2022, up by 233.9% with annual sales having increased by 269.2% to 19 432 tons.

China’s sales to Vietnam rose by a staggering 1 621% over the past 12 months, reaching 1 446 tons. However, sales of 131 tons to Australia in March surpassed Vietnam’s business. The price in Australia was lower than Vietnam’s, but annual sales to Australia remain half of what they were in 2021, totalling 477 tons. Overall, China’s annual export earnings have increased by 139.2% compared to the previous year, reaching RMB 1.23 billion (US$178 million; €160 million).

It was a weak March for importers as Chinese imports of processed potato products reached only 2 575 tons, showing a slight improvement of 600 tons compared to February. However, this is a significant decrease of 46.3% compared to the previous year. Despite a low price of RMB 8 704/ton (US$1 259/t; €1 132/t) in February, sales from the US increased to 1 613 tons.

The price increase from RMB 8 704 to RMB 9 484/ton (US$1 372/t; €1 233/t) did not seem to have a major impact. It was only 16.2% higher than the price a year ago, which is well below the average import price rise of 26.7%. Annual sales from the US remain significantly lower at 19 658 tons, a decrease of 42.4%. The overall import market declined by 50.3% during the same period, totalling 35 586 tons.

Belgium lowered its price by more than RMB 1 000 to RMB 9 244/ton (US$1 337/t; €1 202/t), resulting in a modest increase of 80 to 555 tons compared to the previous year. However, annual sales for Belgium have decreased by 42.9% to

4 574 tons. Turkey had a challenging month with sales of only 154 tons and the highest price among the main importers at RMB 10 015/ton (US$1 449/t; €1 302/t). Its annual sales are down by 34.7% to 7 299 tons.

The Netherlands, the only other importer in March, experienced a slight decline with sales of 252 tons, a decrease of 40 tons compared to the previous month. Despite having the lowest price at RMB 9 131/ton (US$1 321/t; €1 187/t), its annual sales have also decreased by 32.9% to 2 365 tons.

Good month for New Zealand

New Zealand experienced its best month for fry exports since early 2020, with sales reaching 6 698 tons in March, a 44.9% increase compared to the previous year. The strong demand in Australia, where domestic crop issues have arisen due to recent weather events, has been a key factor in this growth. Despite facing challenges in processing potato exports since mid-2020, New Zealand has benefitted from Australia’s supply difficulties.

Sales to Japan also saw improvement, with 259 tons sold in March, a 41.5% increase from the previous month. However, the price to Japan has risen sharply in the past year, up by 60.6% to NZ$2 575/ton.

The future of New Zealand’s exports relies on its performance in the growing Southeast Asian markets, particularly Thailand, Malaysia, Indonesia and the Philippines. Sales to Thailand increased by 18% this month, while sales to Malaysia were nearly three times higher than the previous month, marking a 22% increase from a year ago.

Sales to the Philippines decreased by 18.8% in March, resulting in an annual sales decline of 23.7%. Sales to Indonesia continue to struggle, with a significant drop of 95.1% compared to a year ago.

The high freight costs faced by New Zealand exporters, along with emerging competition from China and India, have affected the country’s ability to compete in Southeast Asia. Despite higher export prices, which have contributed to a 78% increase in March’s total export earnings compared to the previous year, challenges remain.

Fry imports into New Zealand have started to rise, reaching 1 740 tons in March, albeit still 4.4% less than last year. Australia and the Netherlands have been the main suppliers, with Australian fries priced at NZ$2 366/ton and Dutch fries at NZ$1 922/ton. – PJ Nell, Potatoes SA

For more information and references, email the author at pj@potatoes.co.za or Lynne Roos at lynne@potatoes.co.za.